If you are thinking of working in Japan, let me tell you about taxes. When you work in Japan and receive a salary, you have to pay taxes. I will tell you what kind of taxes you have to pay in Japan. Japanese people are paid a lot of salary. But they have to pay a lot of taxes. There is generous protection, but that is because they pay taxes. Japanese people work 12 months and pay 3 months of their salary as tax.

How about in your country? Please tell us how taxes are different between your country and Japan, if you don’t mind.

Taxes deducted from wages

To get a job in Japan, you will need a work visa.

If you work in Japan, you will work as a company employee. When you work as a company employee, you will receive a monthly salary. When you receive your salary, you will receive a pay stub. On this paper, it is written that you paid as taxes from your salary. When you work for a company? With the salary you get from the company. Actual. There is a difference between the salary you get. This difference is the tax.

When you receive your salary. Some taxes are deducted from your salary. Some taxes are paid by you while you are living your life. The following is a list of items that appear on your paycheck.

A typical paycheck may include the following items. However, it may vary by company and employment conditions, so specific pay stubs may vary depending on individual circumstances.

Base salary (basic salary): This is the basic salary amount. Various allowances and bonuses are usually added to this amount.

Allowances: These are items such as transportation, family allowance, overtime allowance, housing allowance, commuting allowance, and other allowances based on work and living conditions.

Overtime Allowance: This is an allowance for work outside of business hours. It may be paid in accordance with the law.

Surcharge: An allowance with a premium rate for working on legal holidays and late-night hours.

Bonuses: Bonuses paid several times a year. It usually includes a year-end bonus and a summer bonus.

Deductions: Deductions for income tax, inhabitant tax, health insurance premiums, and employee pension premiums. They may be deducted from the salary.

Social insurance premiums: The amount of premiums for social insurance such as health insurance premiums and employee pension insurance premiums.

Withholding Tax: The amount of withholding tax such as income tax and inhabitant tax. The amount of taxes withheld from your salary.

Take-home pay: The amount of money actually remaining after taking into account various deductions and allowances in the salary schedule.

Pension Plan Enrollment Information: Information on enrollment in employee pension insurance and the amount of premiums paid may be included.

Work days and attendance information: Information on the number of days worked per month and attendance information, such as late arrivals and early departures, may be included.

Pay stubs vary from country to country and region to region, and may also vary depending on company policies and conditions of employment. It is important to familiarize yourself with your pay stub and check with your human resources department or payroll representative if necessary.

Taxes you pay when you live in Japan

When you live in Japan. You pay a lot of taxes. There is a difference between the salary you receive and the salary you can actually spend. There is a difference between the salary you receive and the salary you can actually spend. Even if you receive a salary, about 40% of it goes to taxes. You pay as taxes. The items are summarized below.

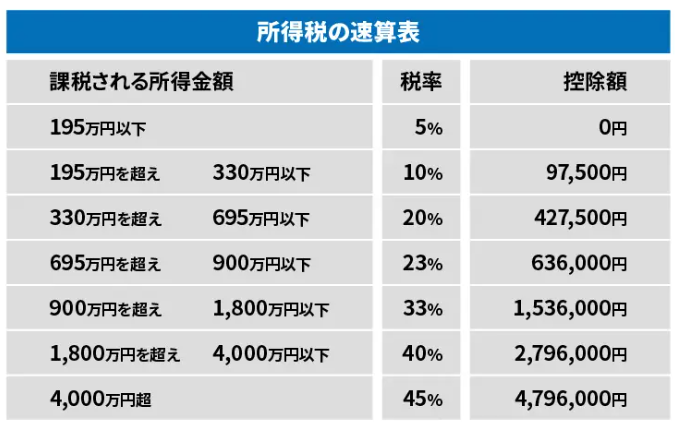

Income Tax (Income Tax Law): This tax is levied on income such as wages and business income. For individuals, it is withheld at source or paid through year-end adjustments.

Resident’s tax (Local tax law): A tax levied in the area of residence as a resident of a municipality. It is based on income and is paid together with income tax.

Consumption tax (Consumption Tax Law): A tax imposed on purchases of goods and services. There are two types of tax rates: general and reduced.

Property tax (Local Tax Law): A tax on real estate owned (land, buildings, etc.). The tax rate differs from municipality to municipality.

Automobile tax (Automobile Tax Law): A tax levied on owners of automobiles. The amount of tax is determined by the type and displacement of the vehicle.

Social insurance premiums: These are the amount of premiums for social insurance such as health insurance and welfare pension insurance.

In Japan, there are two rules: National Pension Insurance and Health Insurance. National Health Insurance reduces the cost of going to the hospital. The National Pension Plan provides money when you reach 65 years of age or older. This is not a tax, though. It is almost a tax because it must be paid.

コメント